gomyfinancecom create budget - Simple Money Plans

Feeling a little uncertain about where your money goes each month? It's a pretty common feeling, you know. Many folks find themselves wondering why their bank account seems to shrink faster than they expect, even when they're trying to be careful. The idea of having a clear picture of your finances can feel like a big weight lifted, allowing you to breathe a little easier and, in some respects, feel more in control of your daily spending.

That's where putting together a spending plan, or what most people call a budget, comes into play. It's not about cutting out all the fun things; instead, it's really about giving every dollar a job, so you know exactly what it's supposed to do for you. This kind of thoughtful money management can help you move from just reacting to your bills to actually shaping your financial future, which is that kind of calm feeling you want.

And this is where a tool like gomyfinancecom can step in to help you create budget plans that actually stick. It aims to simplify what might seem like a complicated task, making it more approachable for everyday people who just want to get a better handle on their cash flow. We're going to explore how using this kind of platform can help you feel more confident about your money, more or less, every single day.

Table of Contents

- What is a budget, anyway?

- Getting Started with gomyfinancecom create budget

- Why bother with a budget?

- Making your money work for you with gomyfinancecom create budget

- Can gomyfinancecom create budget really help me?

- Tips for sticking to your gomyfinancecom create budget plan

- What if my gomyfinancecom create budget isn't working out?

- Beyond the Basics- gomyfinancecom create budget for bigger goals

What is a budget, anyway?

So, you might hear the word "budget" and immediately think of strict rules, deprivation, or maybe even a bit of a headache. But honestly, it's really nothing like that at all. A budget, at its core, is simply a spending plan for your money. It's a way to look at how much money comes in and how much goes out, giving you a very clear picture of your financial situation. It's about making conscious choices about your earnings, rather than letting them just slip through your fingers without much thought. It's a tool, you know, to help you reach your money goals, whether that's saving for something special, paying off a bill, or just feeling less stressed about finances. It's pretty much a roadmap for your cash.

Getting Started with gomyfinancecom create budget

When you decide to use gomyfinancecom to create budget plans, the first step is usually pretty straightforward: you'll likely begin by gathering up all your financial information. This means knowing what your income is, whether that's from a job, a side hustle, or other sources. Then, you'll want to get a good handle on your regular expenses. This includes things that are fixed, like your rent or mortgage payment, and those that can vary a bit, such as what you spend on groceries or going out. The platform, you see, is built to guide you through putting all these numbers in the right places. It asks you questions about your spending habits, helping you categorize where your money typically goes. This initial setup is, in a way, the foundation for everything else, making sure your plan is built on accurate information, which is something that really helps.

After you've put in your income and expenses, gomyfinancecom helps you see where your money is actually going. It might show you, for instance, that a bigger chunk of your earnings is going towards eating out than you thought, or that you're spending more on subscriptions than you realized. This kind of insight is quite valuable because it helps you spot areas where you might want to make some adjustments. The goal is not to judge your spending, but rather to give you a clear view so you can make choices that feel right for you. It’s about being aware, which is pretty much the first step to feeling more secure about your money. You get to decide what changes, if any, you want to make to your gomyfinancecom create budget.

Why bother with a budget?

You might be thinking, "Why should I put in the effort to create a budget?" Well, there are many good reasons, actually. One of the biggest is gaining a sense of control over your financial situation. When you have a budget, you're not just guessing where your money is going; you have a very clear picture. This can reduce a lot of the stress that comes with money worries. It helps you avoid those moments where you wonder why your bank account is lower than you expected before the month is even over. A budget allows you to make conscious decisions about your money, aligning your spending with your personal values and what you really want to achieve. It’s pretty empowering, honestly, to feel like you are the one driving your financial journey.

Another excellent reason to have a budget is to help you work towards your financial goals. Whether you dream of saving for a down payment on a house, putting money away for a fun trip, getting rid of some debt, or building up an emergency fund, a budget provides the structure you need. It helps you identify how much you can realistically set aside for these goals each month. Without a plan, these aspirations can feel distant and maybe even a little impossible. But with a solid budget, you turn those dreams into actionable steps, making them feel much more within reach. It’s like having a clear path to follow, which is quite helpful when you're trying to get somewhere specific with your money.

Making your money work for you with gomyfinancecom create budget

Once your initial budget is set up, gomyfinancecom becomes a tool that helps you keep track of your spending in real time. It’s not just a one-time thing you set and forget; it's something you check in with regularly. As you spend, you can record those transactions, and the platform helps you see how much you have left in each of your spending categories. This constant feedback is really valuable because it lets you know if you're staying within your limits or if you might need to pull back a little in certain areas. It's about being aware, you know, of your financial situation as it happens, rather than getting a surprise at the end of the month. This kind of ongoing awareness is pretty much key to making a budget truly effective for you.

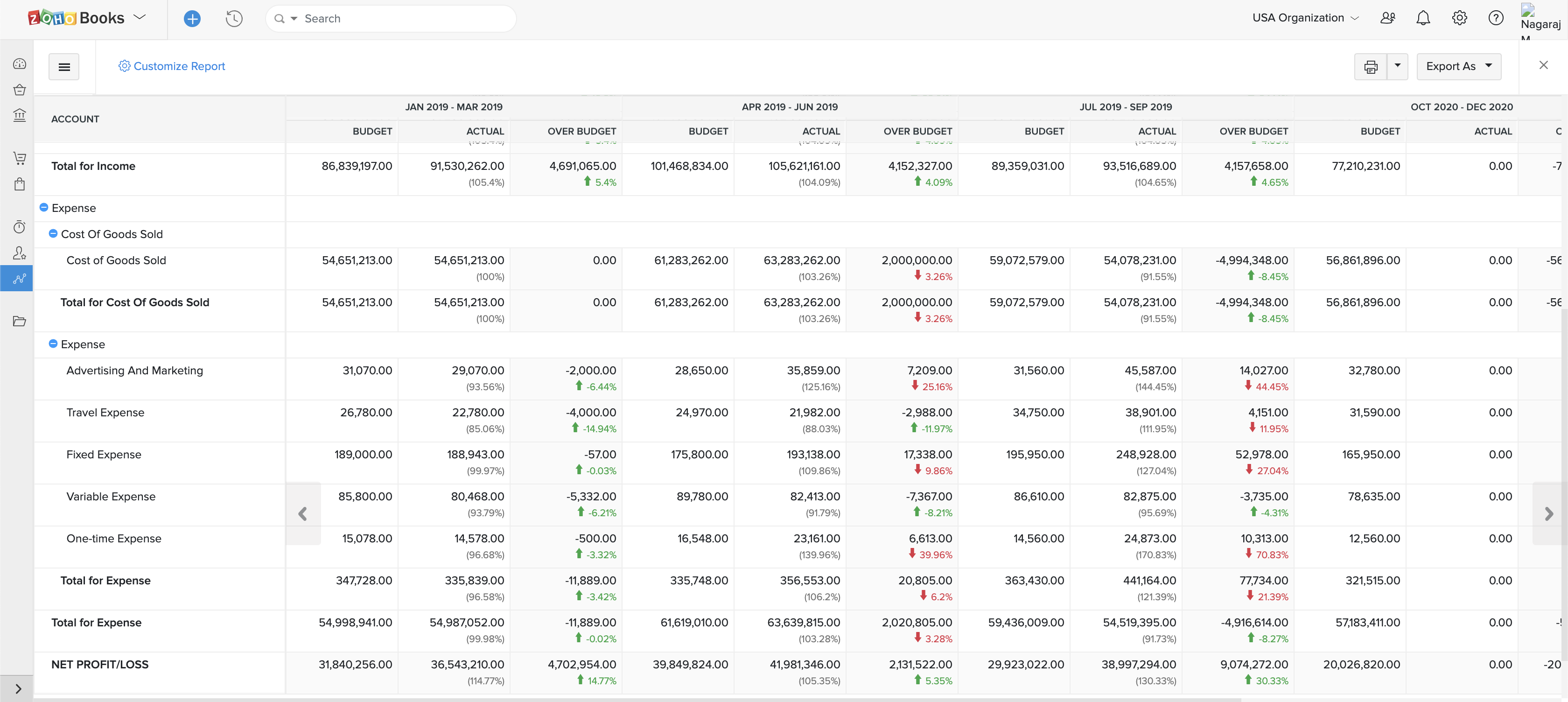

The system also helps you visualize your money flow, often through charts or graphs that make it easy to understand. You can see, for example, a pie chart showing what percentage of your income goes to housing, food, transportation, and fun stuff. This visual representation can be a real eye-opener, giving you insights into your spending habits that you might not have noticed otherwise. It helps you spot trends and areas where you might be overspending without even realizing it. By having this clear picture, you can make informed choices about where to adjust your spending to better match your financial goals. It’s like having a financial dashboard that shows you exactly what’s going on with your money, which is very helpful.

Can gomyfinancecom create budget really help me?

You might be wondering if a tool like gomyfinancecom can genuinely make a difference for someone like you. The answer, for many people, is yes. The way it's set up, it tries to take some of the intimidation out of managing money. It breaks down the process into smaller, more manageable steps, which can feel a lot less overwhelming than trying to figure everything out on your own. It's designed to be user-friendly, meaning you don't need to be a financial wizard to get started. The prompts and categories guide you, making it easier to input your information and understand the results. It's pretty much like having a friendly guide walking you through the process, which is often what people need when they are starting out with something new like this.

Furthermore, the platform offers a consistent place to keep all your financial information. Instead of scattered notes, bank statements, and receipts, everything is in one spot. This centralization helps you get a complete view of your money at any given time. It can also help you identify patterns in your spending over weeks and months, allowing you to make more informed decisions about future financial choices. For instance, you might notice that your utility bills are consistently higher in certain seasons, allowing you to plan for those fluctuations. This kind of organized approach to your money can lead to a much calmer feeling about your overall financial health, you know, which is something everyone wants a bit more of.

Tips for sticking to your gomyfinancecom create budget plan

Once you’ve put together your budget with gomyfinancecom, the next step is actually sticking with it, which can sometimes be the trickiest part. One helpful tip is to check in with your budget regularly. This doesn't mean obsessing over every single penny, but maybe taking a few minutes each week to review your spending and see how you're doing against your plan. This consistent checking helps you stay aware and make small adjustments as needed, rather than waiting until the end of the month when things might feel out of whack. It’s about creating a habit, basically, a routine that becomes a natural part of how you manage your money, which really helps in the long run.

Another good idea is to be realistic with your budget. If you try to cut out every single non-essential expense all at once, you might find it very hard to stick to. It's okay to include money for things you enjoy, like going out with friends or buying a new book. The key is to allocate a specific amount for these things so you know your limits. A budget that allows for some fun is much more likely to be successful than one that feels overly restrictive. Remember, the goal is to make your money work for you, not to feel like you’re constantly depriving yourself. It’s about balance, you know, finding that sweet spot where you can save and still enjoy life, which is what many people aim for.

Also, don't be afraid to adjust your gomyfinancecom create budget as your life changes. Life is pretty unpredictable, and your financial situation can shift due to new jobs, unexpected expenses, or even just changes in your priorities. Your budget should be a living document, something you can tweak and modify to fit your current circumstances. If you find that a certain category is consistently too low or too high, it's perfectly fine to make an alteration. This flexibility is a strength, not a weakness, because it means your budget remains a useful tool that adapts with you. It’s about making it work for your actual life, which is really important for its long-term success.

What if my gomyfinancecom create budget isn't working out?

It's totally normal if, after a while, you find that your gomyfinancecom budget isn't quite hitting the mark. This doesn't mean you've failed or that budgeting isn't for you. It just means it's time to take a look at what's happening and make some changes. Perhaps your initial estimates for certain expenses were a little off, or maybe an unexpected cost came up that threw things for a loop. The important thing is to approach it with a calm attitude, seeing it as an opportunity to learn and refine your plan. It’s like when you’re trying a new recipe, you know, sometimes you have to adjust the ingredients a bit to get it just right, and money management is pretty similar in that way.

One common reason a budget might not work as planned is if it's too restrictive. If you've cut too many things you enjoy, you might feel a bit suffocated by your plan, making it hard to stick to. In this case, you might want to go back into gomyfinancecom and give yourself a little more wiggle room in certain categories. On the other hand, sometimes expenses are just higher than expected. This might mean looking for ways to reduce those costs, like finding a different internet provider or cooking more meals at home. The platform gives you the data to see where these discrepancies are, making it easier to figure out where to focus your attention. It's all about making small, manageable adjustments until your budget feels comfortable and effective, which is what you're really aiming for.

Beyond the Basics- gomyfinancecom create budget for bigger goals

Once you get comfortable with the regular ins and outs of using gomyfinancecom to create budget plans for your daily and monthly spending, you can start thinking about how this tool can help you with bigger financial aspirations. A well-managed budget isn't just about paying bills on time; it's also a powerful stepping stone towards achieving those larger life goals. For instance, if you're dreaming of saving up a substantial amount for a down payment on a house, or perhaps planning for a comfortable retirement, your budget becomes the framework that makes those dreams a bit more concrete. It helps you identify exactly how much extra money you can put towards these long-term objectives each month, which is really helpful for seeing progress.

You can use the insights from your gomyfinancecom create budget to identify areas where you can free up more money for these bigger targets. Maybe you realize you're spending a certain amount on things that don't bring you much joy, and you decide to redirect that money towards a savings goal instead. Or perhaps you find that by making a few small changes, you can consistently put an extra sum into an investment account. The platform gives you the clarity to make these strategic decisions, turning abstract goals into actionable steps. It’s pretty empowering, honestly, to see how your everyday spending choices can contribute to your long-term financial well-being, which is what budgeting is all about in the end.

The consistent practice of budgeting, aided by a tool like gomyfinancecom, builds a strong foundation for your financial future. It helps you develop good money habits, teaches you about your own spending patterns, and gives you the confidence to make informed financial decisions. Over time, this consistent effort can lead to a feeling of greater financial security and the ability to pursue opportunities that might have seemed out of reach before. It's about building a healthier relationship with your money, you know, one where you're in charge, which is a pretty good place to be.

So, putting together a spending plan with gomyfinancecom to create budget clarity can really help you get a better handle on your money. It's about seeing where your cash goes, making thoughtful choices, and working towards your financial hopes. By using a tool like this, you can feel more confident and in control of your earnings, which is a very good feeling to have.