When money worries begin to feel like a heavy weight, especially with bills piling up, it can seem like there is no way out. Many people find themselves in a place where what they owe feels overwhelming, making daily life quite a bit harder. This feeling of being stuck is, you know, a very common experience for so many folks today.

There are, thankfully, pathways to lighten that load, to perhaps find a way back to a more settled financial situation. Getting help with what you owe can often be the first step in feeling more in control, and it's something that many people consider when their finances feel a little out of balance. It really is about finding a new direction, isn't it?

One option that comes up for those looking for some assistance with their financial obligations is First Advantage Debt Relief. This guide will, in a way, walk you through what this particular company offers, helping you get a clearer picture of how they might be able to lend a hand with those lingering money concerns. So, let's explore what they are about.

Table of Contents

- What is First Advantage Debt Relief All About?

- How Does First Advantage Debt Relief Work for You?

- Who is First Advantage Debt Relief Typically For?

- What Kinds of Money Problems Can First Advantage Debt Relief Help With?

- Getting Started with First Advantage Debt Relief

- Support and Resources from First Advantage Debt Relief

- Considering First Advantage Debt Relief

- Making an Informed Choice About First Advantage Debt Relief

What is First Advantage Debt Relief All About?

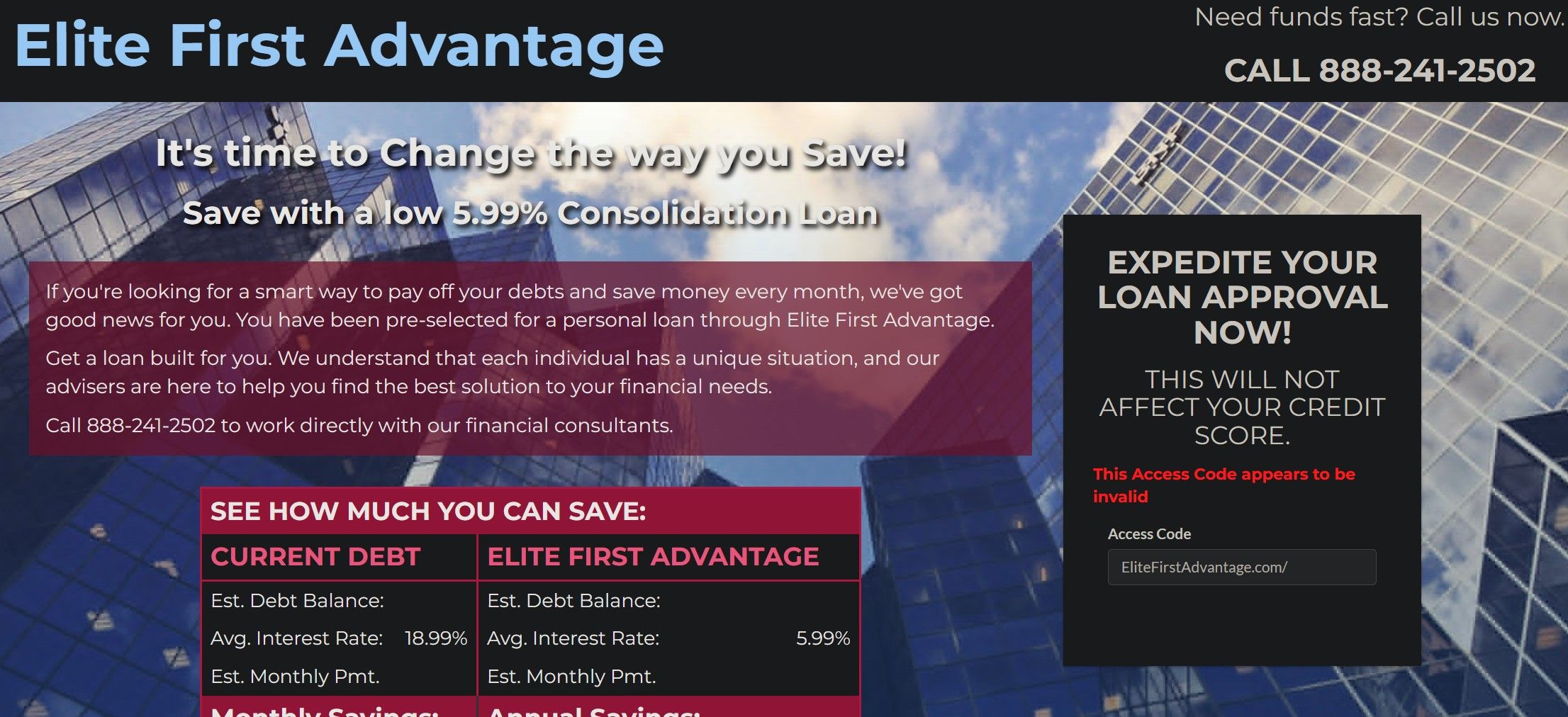

First Advantage Financial offers a way for people to apply for help with their outstanding financial commitments. It's a system, you know, that aims to give individuals a chance to get their money matters back on track. The whole idea is to provide a path where you can begin to feel steady again with your personal finances. This particular company focuses on providing a way out of what can feel like a very tight spot for many people, especially when various bills are adding up.

Their way of working involves an online setup, which is quite convenient, really. This online space is where they present options that are, in a way, made just for you. The goal here is to help you get back to a solid financial standing, allowing you to regain that sense of peace that comes with having your money situation sorted out. It's about finding personalized ways to help you feel more stable with your funds, which is pretty important for anyone feeling squeezed by what they owe.

As a company, First Advantage is in the business of offering ways to solve financial problems, specializing in services that reduce the burden of credit card bills. So, if you have a lot of credit card balances that are causing you stress, they are, in some respects, set up to address that specific kind of financial pressure. They aim to be a source of solutions for those particular money challenges, which can be a relief for many who feel bogged down by credit card obligations.

How Does First Advantage Debt Relief Work for You?

The company, First Advantage Debt Relief, is essentially set up to offer assistance to people who are experiencing financial difficulties because they have a lot of money owed. They understand that having too many bills can be a really tough situation, and their purpose is to provide a way to help ease that burden. It’s about reaching out to those who are struggling with what feels like a very high amount of financial commitments, offering a helping hand, so to speak.

They put forward the idea that they can help by arranging what's called debt settlement services. This means, basically, that they work to resolve unsecured bills, such as credit card balances, medical bills that have accumulated, and personal loans. The process involves trying to come to an agreement with those you owe money to, with the aim of reducing the total amount you have to pay back. It's a specific kind of support, really, focused on getting those particular types of financial obligations sorted out.

Beyond just settlement, First Advantage Debt Relief also provides valuable ways to manage costs and get legal backing. This can be quite useful for people who are not only trying to reduce what they owe but also need help understanding the financial aspects and perhaps getting some professional legal advice related to their situation. So, they offer more than just one type of assistance; it’s a broader approach to helping with financial stress, which is something many people look for.

Who is First Advantage Debt Relief Typically For?

This is a good question that many people wonder about when they're thinking about getting help with their money. So, who is this kind of financial assistance generally intended for? It’s usually for individuals who find themselves with a significant amount of unsecured financial obligations, like those credit card bills that seem to keep growing, or perhaps medical expenses that have become unmanageable, or even personal loans that are just too much to handle. It's for anyone who feels caught in a cycle of payments that they just can't keep up with, you know, and needs a way to break free.

It's for people who are, in a way, looking for a fresh start with their finances, someone who is ready to take steps to address their money problems head-on. If you've been trying to manage on your own but the numbers just aren't adding up, then this kind of support might be something to look into. It’s about recognizing that you need some specialized help to get back on solid ground, and that's perfectly okay. Many people reach this point, and it’s a sign of strength to seek assistance.

Essentially, it’s for someone who is feeling the weight of what they owe and wants to find a structured path to lessen that burden. They might be getting calls from bill collectors, or just generally feeling a lot of stress about their financial future. So, if that sounds a bit like your situation, then exploring options like First Advantage Debt Relief could be a very sensible next step for you.

What Kinds of Money Problems Can First Advantage Debt Relief Help With?

When we talk about the specific types of money troubles that First Advantage Debt Relief focuses on, it's pretty clear that they specialize in helping with unsecured financial commitments. What does that mean, exactly? Well, it means the kind of money owed that isn't tied to something like your house or your car. So, you know, it's not about your mortgage or your auto loan. Instead, it’s about those other bills that can pile up and feel just as heavy, if not heavier, in some respects.

For example, a big one they work with is credit card balances. These are, very often, a major source of stress for many people, especially when the interest rates are high and the minimum payments don't seem to make a dent. They also help with medical bills, which can appear unexpectedly and quickly become quite large, causing a lot of worry. And then there are personal loans, which, while sometimes helpful in the short term, can also become difficult to pay back if circumstances change. So, these are the main areas where they lend a hand.

Their approach to these kinds of money problems is through something called debt settlement. This means they try to work with the people or companies you owe money to, with the goal of getting them to agree to accept a lower amount than what you originally owed. It's a way of, basically, resolving those outstanding amounts so you can move forward without the full weight of the original sum hanging over you. It's a specific kind of financial arrangement designed to give you a fresh start with these particular types of bills.

Getting Started with First Advantage Debt Relief

If you're thinking about reaching out for help, learning about their initial conversation and credit guidance is a good first move. This is, basically, where you get to talk to someone about your unique situation, without a lot of pressure. It's a chance to explain what you're dealing with financially and to hear about what options might be available to you. This initial chat is really important for getting a sense of how they might be able to assist you, and it’s a way to start understanding the path forward.

The idea of an initial conversation is just that—a first talk. It’s not a commitment, but rather a chance to explore. During this time, you can ask questions and get a clearer picture of what the process might look like for you. It’s about laying out your financial picture and getting some preliminary thoughts on how they could help ease your burden. This step is, arguably, one of the most important for anyone considering getting help with their outstanding financial commitments.

And then there's the credit guidance part. This involves getting advice on how to improve your financial habits and make better choices with your money going forward. It's not just about solving the immediate problem, but also about building a stronger foundation for your financial future. This kind of advice can be incredibly valuable, helping you avoid similar situations down the road. So, it's about both immediate relief and long-term financial health, which is pretty helpful, you know.

Support and Resources from First Advantage Debt Relief

The company's website is a place where you can find helpful materials and ways to get in touch if you're looking for assistance. It's set up to be a source of information for individuals who are seeking some kind of support with their money matters. So, if you're curious, you can go there to read up on things and find the contact details you need to reach out. It’s pretty straightforward, really, designed to make it easier for you to connect with them.

These materials on the website are there to give you a better idea of what they do and how they might be able to help. They can offer some initial thoughts on common money concerns and what kind of solutions they offer. It’s a good starting point for anyone who wants to learn more before making a phone call or sending an email. In a way, it’s like having a preliminary chat without actually talking to someone yet, just getting the basic facts.

And the contact information is, of course, very important. It means you have a direct line to ask specific questions about your own situation. Whether it's a phone number or an email address, having that direct connection allows you to move beyond general information and discuss your personal financial challenges. This ability to reach out directly is, you know, a key part of getting the personalized help that many people need when dealing with their outstanding financial commitments.

Considering First Advantage Debt Relief

This information is here to help you get a clearer picture of First Advantage Debt Relief. We want to help you understand what it is, how it generally works, and whether it could be a suitable option for your particular situation. It's about giving you the details so you can make a choice that feels right for you and your money. So, it's not about telling you what to do, but rather giving you the facts to consider, which is, you know, quite important when dealing with personal finances.

Thinking about what it is, we've covered that it's a company that helps with various kinds of outstanding financial commitments, particularly unsecured ones like credit cards and personal loans. The "how it works" part involves their approach to debt settlement, where they try to negotiate on your behalf to reduce the total amount you owe. This whole process is, in some respects, about finding a structured way to deal with what might feel like an overwhelming amount of bills, helping you move towards a more manageable financial position.

And then, perhaps most importantly, there's the question of whether it's the right solution for you. This is a very personal consideration, as everyone's financial situation is different. What works for one person might not be the best fit for another. So, this information is meant to give you the tools to weigh the pros and cons for your own circumstances, allowing you to decide if this path aligns with your goals for getting your money matters in order. It's about making a choice that feels good for your future, really.

Making an Informed Choice About First Advantage Debt Relief

This thorough look at First Advantage Debt Relief aims to give you a clear picture. We've talked about what people have experienced with them, the kinds of services they offer, and also some things that might be less than ideal. The whole point is to help you make a choice that you feel good about, one that is based on solid information rather than just guessing. So, it’s about providing a complete view, which is pretty helpful when you're thinking about big financial decisions.

When we look at what customers have said, it gives you a sense of how the company interacts with people and what kind of outcomes they've seen. This can be, you know, very insightful because it's real-world feedback. It helps you understand the practical side of working with them, beyond just what they say they do. Hearing about others' experiences can often shed light on what you might expect if you choose to work with them, giving you a bit more confidence in your decision.

And then there are the services offered, which we've gone into some detail about, like their focus on debt settlement for unsecured bills. Knowing exactly what they provide helps you match their offerings to your specific needs. Finally, understanding potential drawbacks is just as important. Every service has its ups and downs, and being aware of the possible challenges means you can go into it with your eyes wide open. It’s all about having all the pieces of the puzzle so you can assemble a clear picture before you decide to move forward, which is, after all, what an informed choice is all about.