When businesses change hands, or, you know, when a company's assets get a new home, there are often some pretty specific things that need to be put down on paper for tax reasons. It’s a bit like sorting out who gets what when things are shifting around, especially if it’s a big business deal where one company basically buys another. This sort of paperwork helps everyone involved keep things straight with the tax people, making sure everything is counted correctly.

You see, sometimes a business deal is set up in a way that, for tax purposes, it looks as if a company sold all its stuff, even if it didn't literally sell piece by piece. This is what's called a "deemed sale," and it has its own set of rules. For these particular situations, there is, in fact, a special document that helps everyone involved report what happened. It’s all about making sure the right details are shared with the right folks, so there are no surprises later on.

This particular document helps both the company that's "selling" its assets and the company that's "buying" them to properly tell the tax authorities how they're dividing up the purchase money among the different things that were part of the deal. It's really about making sure everyone is on the same page regarding how the value of the business's belongings is split up. This split, you know, has a big impact on what happens with taxes down the road for both sides.

Table of Contents

- What exactly is Form 8883 for?

- Making sense of 8883 and business changes

- Why does purchase price allocation matter with 8883?

- The importance of 8883 for your future money plans

- Getting your hands on Form 8883

- Where to find 8883 and what to do next

- Who needs to file Form 8883?

- Both sides of the deal and 8883

- How Form 8883 helps with tax reporting

- Keeping your records straight with 8883

- What kind of information goes into Form 8883?

- Bits and pieces of information for 8883

- The history of information on Form 8883

- Looking back at what 8883 collects

- Understanding the "Deemed Sale" aspect of 8883

- What "deemed sale" means for your 8883 filing

What exactly is Form 8883 for?

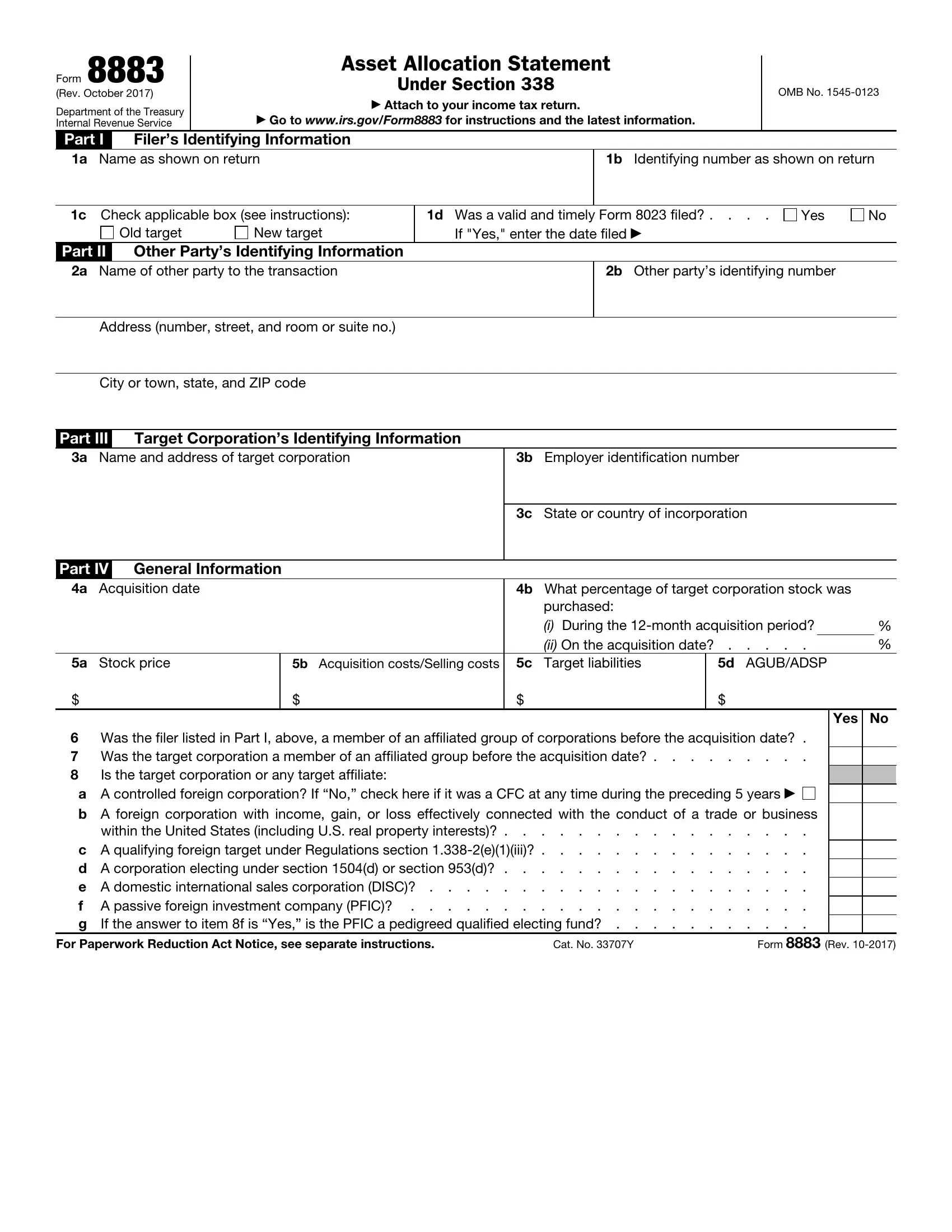

This particular document, Form 8883, is used to share details about certain kinds of business deals. It’s for when a company, you know, appears to have sold all its possessions, at least in the eyes of the tax rules, even if it didn't really have a big yard sale. This happens under a specific tax rule called section 338. So, it's really about making sure the tax authorities get the full picture of these special kinds of sales. It helps them see how the value of a business's belongings is accounted for when a company changes hands in this particular way. It's a way to keep everything organized, you see, for tax purposes.

Making sense of 8883 and business changes

When a business is, you know, acquired, especially when it falls under that section 338 rule, Form 8883 becomes a pretty important piece of paper. It’s the way companies tell the tax people how they’ve split up the money paid for the business across all the different things it owned. This could be anything from its buildings and equipment to its reputation or customer lists. The form, basically, makes sure everyone agrees on how much each part of the business was worth in the deal. This is, in fact, a big deal for future tax calculations, so getting the 8883 right is quite important.

Why does purchase price allocation matter with 8883?

The way a purchase price is divided up among a company's possessions might seem like a small detail, but it’s actually a really big deal for future tax bills. When you buy a business, you're not just buying one big thing; you're buying a collection of assets, like machinery, land, and maybe even things you can't touch, like brand names. How you say you spent the money on each of these items, as recorded on something like Form 8883, directly affects how much tax you might owe or save in the years to come. It’s, you know, about setting up your financial future in a way that makes sense for tax reporting. This allocation, frankly, helps decide things like how much you can write off each year.

The importance of 8883 for your future money plans

Getting this allocation right on Form 8883 is pretty fundamental for how a business handles its money going forward. Different kinds of assets have different rules for how they’re treated for tax purposes. Some things can be, like, written off over many years, while others might be treated differently. If you don't assign the purchase money correctly, it could mean you pay more taxes than you need to, or even, you know, run into issues with the tax authorities later on. So, this form helps lay the groundwork for how a business will report its earnings and deductions for a long time. It’s a bit like setting the stage for future financial reporting, with 8883 playing a starring role.

Getting your hands on Form 8883

For anyone who needs to complete this form, getting a copy is quite straightforward. You can simply go to the official source for federal tax documents, which is the Internal Revenue Service. They make the form available for anyone to get, either to print out themselves or to fill in on a computer. This means you don't have to, you know, jump through hoops to get the paper you need to report these kinds of business asset deals. It's all there, waiting for you to access it, making the process a bit less complicated for those involved. So, finding the 8883 is usually not a problem.

Where to find 8883 and what to do next

When you're ready to get started with your 8883 paperwork, you'll find the most current version, like the one for 2024, directly from the official government tax website. It's available at no cost, which is pretty handy. Once you have the form, the next step is, of course, to start gathering all the information you'll need to fill it out. This often involves looking at the details of the business deal and figuring out how the money was divided among the different things that were part of the acquisition. The site often has instructions or guides to help you understand how to put everything in the right spot on the 8883 itself.

Who needs to file Form 8883?

When a business deal happens that involves this "deemed sale" of assets under section 338, it’s not just one side that needs to report it. Both the company that's considered to have "sold" its assets and the company that's considered to have "bought" them will need to submit this particular form. This means that both parties have to agree on how the purchase money was split up among the different items involved in the deal. It's a way to ensure that the tax authorities get the same story from both sides, which, you know, helps keep everything consistent and fair. So, it's a shared responsibility, in a way.

Both sides of the deal and 8883

Imagine a business deal where one company, let's call it the "old target," is being taken over, and another, the "new target," is doing the taking. In the eyes of the tax rules for a section 338 deal, the "old target" is seen as selling all its belongings, and the "new target" is seen as buying them. Because of this, both of these entities are required to turn in Form 8883. They each have to file it with their own tax documents – the "old target" with its final papers, and the "new target" with its first set of papers after the acquisition. This ensures that the information about the asset split is, you know, properly reported by everyone involved in the transaction. It's a key step for both parties when it comes to 8883.

How Form 8883 helps with tax reporting

This document is a tool that helps businesses accurately report their financial situations to the government, especially after a significant change like an acquisition. It makes sure that the value assigned to each asset, like buildings or equipment, is properly recorded for tax purposes. This recording is really important because it affects how much depreciation a company can claim each year, or how much profit they report when they eventually sell those assets. It's, you know, a foundational piece of information that influences a company's tax picture for years to come. So, in a way, it simplifies what could be a very complex reporting task.

Keeping your records straight with 8883

When you're dealing with something like a business acquisition, there are many financial details to keep track of. Form 8883 serves as a clear record of how the purchase money was distributed among the various things a business owns. This record is then used as a reference point for future tax filings. For example, if the new company sells a piece of equipment later, the original value assigned on the 8883 helps determine the taxable gain or loss. It’s, you know, like a financial map that guides future tax decisions, making sure that everything is consistent and properly accounted for. This clarity that 8883 provides is pretty valuable.

What kind of information goes into Form 8883?

When you fill out Form 8883, you're basically providing a detailed breakdown of how the purchase price of a business was divided up among its different assets. This includes, you know, things like how much was assigned to land, buildings, machinery, and even intangible items like patents or goodwill. The form also asks for other important details, such as the tax year the original deal happened and the number of any related tax forms that were filed at that time. It's all about making sure the tax authorities have a complete picture of the transaction and how the value was distributed. So, it's quite a specific list of items.

Bits and pieces of information for 8883

To make sure the tax people can connect all the dots, Form 8883 requires you to put down the tax year and the form number of the original document where this kind of information was first reported. This could be, for example, an earlier version of Form 8883 itself or even Form 8023, which is related to these types of business elections. This helps the tax authorities link the current filing to past records, ensuring a consistent reporting history. It's, you know, a way of building a complete financial story over time. So, getting these historical references right on 8883 is a key step.

The history of information on Form 8883

The information reported on Form 8883 isn't always brand new; sometimes it includes details that have been shared on other tax documents before. This means that the form helps to, you know, consolidate or update information that was already part of a company's tax record. It ensures that the tax authorities have the most current and complete picture of how assets are valued and allocated after a business acquisition. This continuity is pretty important for maintaining clear and accurate financial records over time, helping to avoid confusion or discrepancies. It's a way of keeping things tidy, you see.

Looking back at what 8883 collects

In some ways, Form 8883 acts as a kind of update or continuation of information that might have appeared on earlier tax forms. For example, some of the details about asset values or the structure of the deal might have been, you know, initially reported on a different document. The 8883 then brings all that information together, or perhaps clarifies it, within the context of the deemed sale under section 338. This helps ensure that all the relevant financial data is consistently presented to the tax authorities. It's a way to make sure that the story told by your tax documents is, in fact, complete and makes sense from beginning to end for 8883.

Understanding the "Deemed Sale" aspect of 8883

The idea of a "deemed sale" might sound a bit, you know, odd at first. It means that for tax purposes, a company is treated as if it sold all its assets to a new, hypothetical company, even if no actual, physical sale of individual items happened. This specific treatment comes from section 338 of the tax code. Form 8883 is the document used to tell the tax authorities all about these kinds of transactions, making sure they understand how the assets are being valued and transferred in this special way. It’s a way of applying a specific tax rule to certain business acquisitions, rather than treating them as a regular sale.

What "deemed sale" means for your 8883 filing

When a business acquisition falls under section 338, the "deemed sale" concept kicks in, and that's when Form 8883 becomes absolutely necessary. It's the official way to tell the tax authorities about this fictional sale of assets. The form helps you report how the overall purchase price of the business is, you know, split up among all the different assets that are considered to have been "sold" and "bought." This split is important for figuring out things like depreciation deductions and future tax gains or losses. So, the 8883 is basically the paperwork that makes this "deemed sale" real for tax purposes, providing all the necessary financial details.